You have probably seen the advertisements - “Trade Forex with 400:1 Leverage” - without being entirely clear as to what exactly these brokers are offering and/or wondering why someone would want to leverage trades to such an extent.

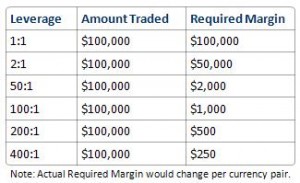

Simply put, forex leverage (also referred to as margin) “is a loan that is provided to an investor by the broker that is handling his or her forex account.” With leverage, you can effectively increase your purchasing power, and buy securities in excess of what you would otherwise be able to afford, with the goal of maximizing relative returns. For example, if you achieve a 25% return on a $2000 trade/investment that was carried out with 2:1 leverage, you actually achieved a 50% return on the $1000 of capital that you personally invested; the other half, by implication, was provided in the form of a loan by the broker. Of course, the inverse also holds, such that a 25% loss would be magnified into a 50% loss, under the same parameters. See the table below for further understand this “multiplier effect.”

While traders can theoretically use margin to trade any kind of financial instrument/security, leverage is especially common in forex. The reason is that currencies are typically bought and sold in units of 50,000 - 100,000, which is more than retail traders can afford, or are willing to commit. Moreover, currencies are not as volatile (outside of the credit crisis, that is) as other securities, and typically don’t fluctuate more than 1% in a given day. Changes are often so minuscule that 1/10000 of a unit (onePip) has become the benchmark for measuring fluctuations. Accordingly, “currency transactions must be carried out in big amounts, allowing these minute price movements to be translated into decent profits when magnified through the use of leverage.”

While traders can theoretically use margin to trade any kind of financial instrument/security, leverage is especially common in forex. The reason is that currencies are typically bought and sold in units of 50,000 - 100,000, which is more than retail traders can afford, or are willing to commit. Moreover, currencies are not as volatile (outside of the credit crisis, that is) as other securities, and typically don’t fluctuate more than 1% in a given day. Changes are often so minuscule that 1/10000 of a unit (onePip) has become the benchmark for measuring fluctuations. Accordingly, “currency transactions must be carried out in big amounts, allowing these minute price movements to be translated into decent profits when magnified through the use of leverage.”

Leverage allows traders to put up only a fraction of the capital required to make a given-sized trade ; with 200:1 leverage, for example, $500 would be enough to fund a $100,000 trade. Unfortunately, leverage always favors the broker, much the same way that casinos benefit on average from extending credit to gamblers. According to one especially cynical commentator: “The game basically works this way: The broker is the shark. The retail trader is the shark food. If you want to make money currency trading, give yourself a fair chance and our advice is not to go more than 10x.”

A browsing of forex chat rooms and message boards reveals a surplus of disaster stories involving leverage, such that one can safely conclude that excessive leverage almost invariably leads to excessive losses. This lesson even seems to apply to institutional investors, despite the perception that they have an edge when trading forex, and hence would seem to represent excellent candidates for making leveraged trades. In the context of the current economic quagmire, “Investment banks were trading with 40:1 leverage in some cases. The banking crisis in the US was caused by banks not buying based on solid fundamentals and using insane leverage to buy securities.”

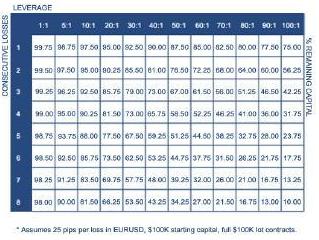

When trading a strategy that is based on technical analysis, “Even though you find one with 80-90% successful system on the paper, when you trade it usually come down 60%. So if we are losing at 40% of the time it is essential that we control risk.” Accordingly, putting more than 3% of your capital at risk on a given trade would seem suicidal. Applying more than 20:1 leverage (which seems trivial compared to 400:1) is very dangerous when you consider that a relatively benign 25 pip decline would result in a 5% loss. You can use the matrix below to calculate a “worst-case” scenario and figure out how much leverage you can get away with in the event that your trading strategy fails on consecutive occasions. It is surely much lower than you expected!

To give you an idea as to how excessive forex leverage has become, consider that the Financial Industry Regulatory Authority (FINRA) recently submitted a proposalthat would prevent retail forex brokers from offering customers more than 1.5:1 leverage. While it’s possible that “The FINRA proposal sadly appeals to the lowest common denominator: the people who over-leverage positions with inappropriate stop-losses,” it nonetheless serves as a testament both to the danger of excessive leverage and to the importance of adequate risk management.

To give you an idea as to how excessive forex leverage has become, consider that the Financial Industry Regulatory Authority (FINRA) recently submitted a proposalthat would prevent retail forex brokers from offering customers more than 1.5:1 leverage. While it’s possible that “The FINRA proposal sadly appeals to the lowest common denominator: the people who over-leverage positions with inappropriate stop-losses,” it nonetheless serves as a testament both to the danger of excessive leverage and to the importance of adequate risk management.

0 comments:

Post a Comment