Dollar ends week in the lowest level for 2009

Saturday, May 23, 2009

EUR/USD rose in the week 4% and ended above 1.4000 (highest since December). The pair has been rising after bottoming on Monday at 1.3425. Since then the pair has been moving in an up trend. Against the Pound, the Euro rose today but not enough to erase weekly losses.

GBP/USD is ending the week above 1.5900. With today increase of 0.33% from opening price, the Pound has completed five consecutive days of gains against the Dollar. During the American session the pair tested the 5-month high at 1.5940 reached during the European session but failed to break above.

USD/CHF has ended the week below 1.0800 for the first time since December. The pair also fell the five days of the week completing a rally of almost 400 pips. Today the pair has fallen 0.66% from opening price.

The Dollar could only make progress against the Yen rising modestly 0.49% but not enough to recover of weekly losses. This is the third consecutive week with negative results for the Dollar. Yen lost across the board during the week but in a smaller scale compared to the greenback.

Forex: USD/JPY hits 94.90

The yen is weaker across the board. Against European currencies is losing for the day. GBP/JPY broke an important resistance and now is at 150.85 (one-month high). EUR/JPY is above 132.00 rising 1.27% since the begging of the day.

Forex: EUR/USD hits 1.4051 fresh 4-month high

Against the Yen, the Euro is also stronger. EUR/JPY broke above 132.00 rising to 132.70 which is the highest of the week. So far today the par has risen 1.11% from opening price.

Forex: EUR's advance continues, 1.4040, fresh 4-month high against USD

The current week, Euro has won 4.0% against Dollar from 1.3480 Monday opening price to reach 1.4040, 4-month high.

Despite signs advancing a correction lower, the Euro bullish trend is strong enough: "Pair reached 1.4000 and at the time, rebound there yet bullish trend is strong enough for another peak higher. Current candle open under previous doji close, suggesting the beginning of a short downside correction as long as maximum remains unbroken, that could reach the 20 SMA that’s losing steam around 1.3935."

Forex: GBP/USD rises 5.0% so far this week, back above 1.5900

GBP/USD is trading its fifth consecutive positive day after trading in Monday low at 1.5115 to win 850 pips to reach fresh 6-month high at 1.5945. The current week the Sterling is gaining almost 5.0% against Greenback from 1.5170 Monday opening to the current 1.5910.

Uptrend in cable could be focusing in 1.60 zone: "Bullish momentum continues slowly addressing to the key 1.60 zone. Hourly indicators suggest more upside bias in the pair, while price remains well bid above 20 SMA. Expected acceleration above 1.5950. Support levels: 1.5890 1.5840 1. 5770. Resistance levels: 1.5950 1.6000 1.6030."

Forex: EUR/USD tests today's high

The Euro has been rallying continuously for the whole week and from 1.3425 low on Monday EUR/USD has reached a 4 month high at 1.4030 ahead of Friday's U.S. session opening.

Affirms that, despite signs advancing a correction lower, the Euro bullish trend is strong enough: "Pair reached 1.4000 and at the time, rebound there yet bullish trend is strong enough for another peak higher. Current candle open under previous doji close, suggesting the beginning of a short downside correction as long as maximum remains unbroken, that could reach the 20 SMA that’s losing steam around 1.3935."

Forex: USD/JPY jumps up to reach 94.75, intra-day high

Currently the pair is trading around 94.60/70, 0.80% above today's opening price.

"Pair seems to be forming a floor in the hourly chart, consolidating between 93.85 and 94.30. Now attempting to break above 20 SMA at 94.15, pair needs to break range to confirm further bias. Hourly indicators suggest upside continuations as the pair seems to not have enough sellers at actual levels. Bigger time frames also suggest pair is exhausted to the downside, daily close could be key for the pair. Support levels: 93.83 93.48 93.10. Resistance levels: 94.30 94.60 95.10."

Forex: EUR/USD: Euro eases from 1.4030 high

Resistance levels lie at intra-day high at 1.4030 and above here, 1.4055 (January high) and 1.4145, (Dec 31 high). On the downside, immediate support level remains at the 13925/40 area, and below there, today's low at 1.3895 and 1.3865.

According to Valeria Bednarik, collaborator at FXstreet.com, affirms that, despite signs advancing a correction lower, the Euro bullish trend is strong enough: "Pair reached 1.4000 and at the time, rebound there yet bullish trend is strong enough for another peak higher. Current candle open under previous doji close, suggesting the beginning of a short downside correction as long as maximum remains unbroken, that could reach the 20 SMA that’s losing steam around 1.3935."

U.S. markets slighly down at the opening; Dollar continues weakening

Dow Jones Industrials Index drops 0.20% while the Nasdaq index falls 0.60% and the S&P Index sheds 0.40% in the first half hour of trading.

The financial sector is mixed after the failure of Bank United Financial, the 34th bank failure this year so far, which reminds the delicate situation of the baking sector, despite the satisfying performance of the largest banks on the recent "stress test".

Euro Pound and Yen at mid-term highs

The Euro has strengthened further ahead of the U.S session opening and the pair has reahed levels above 1.4000 for the first time since early January, hitting 1.4030 so far.

GBP/USD has advanced to levels above 1.5900 ahead of the U.S. session opening to hit a fresh 6-month high at 1.5945, ti ease to levels right above 1.5900 later on. At the moment, the Pound moves around 1.5880.

USD/JPY is testing resistance level at 94.25 after having bounced at 2-moths low 93.85 ahead of the U.S session opening.

Canada retail sales, up 0.3% in Mar, USD/CAD dips further

The monthly increase has been substantially lower than the 0.5% increment expected by the market. Year on year, retail sales have increased 4.8%.

The USD/CAD decline from 1.1815 high on May 18 has extended to a fresh 7-month low at 1.1203 shorly after the release of Canadian retail sales.

According to Anna Coulling, technical analyst at Master the Markets, indicators show the poair pointing down to 1.1000: "With all three moving averages bearing down on the chart this price action has continued in early trading this morning with a further steep decline which now brings the 1.1 into view and given the present rate of fall this target could easily be reached in the next couple of days, at which point a return to parity becomes a distinct possibility in the medium term, and the only area of resistance now likely to impede this target lies at 1.08."

Asian Currencies Rally for Third Straight Month

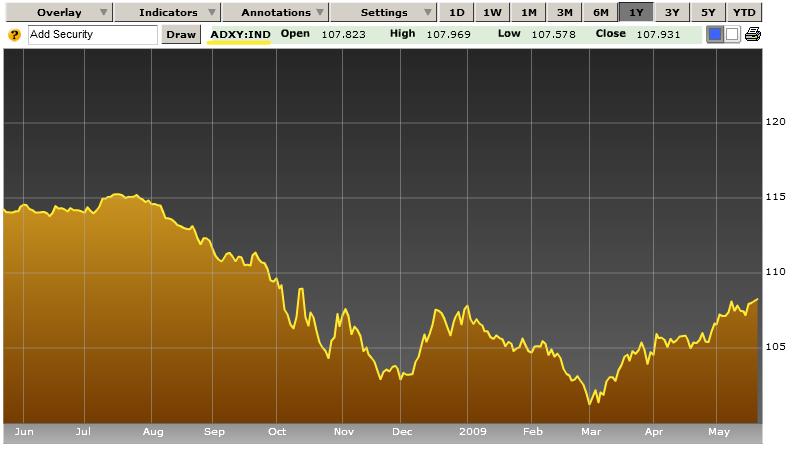

This uptick in sentiment is somewhat unspectacular, since “The Bloomberg-JPMorgan Asia Dollar Index, which tracks the 10 most-active regional currencies,” has now risen for almost three consecutive months [See chart below]. Leading the pack are the Taiwan Dollar and South Korean Won, which recently touched five-month and seven-month highs, respectively. “The Korean currency has climbed 28 percent since reaching an 11-year low of 1,597.45 in March.”

Investors are now pouring money back into Asia at rapid clip. “Asia ex-Japan received $933 million in the week ended May 20, the most among emerging-market stock funds, bringing the total this year to $6.9 billion.” Meanwhile, the “The MSCI Asia Pacific Index of regional stocks climbed 22 percent this quarter” while Chinese stocks are up 45% since the beginning of 2009.

But it’s unclear - doubtful is a better word - whether this rally is supported by economic fundamentals. One commentator summarized this contradiction as follows: “Improved sentiment has led to a massive resurgence in flows to emerging markets, irrespective of the underlying data, which remains weak. Investors are going out of dollars to riskier markets, riskier currencies.”

Let’s drill down into some of the data. Chinese exports fell 15% in April. Japan’s economy contracted 15% in the most recent quarter. Singapore’s exports are down 20% on an annualized basis. The South Korean economy is projected to shrink by 2% this year. The Central Bank of Thailand just cut its benchmark interest rate to an unbelievable 1%. The only bright spot economically is Taiwan, which is benefiting both from improved economic ties with China and a healthy current account surplus. I suppose everything is relative, as “developing Asian economies will grow 4.8 percent in 2009, even as the world economy contracts 1.3 percent” according to the International Monetary Fund.

The notion that the rally is not rooted in fundamentals is shared by the region’s Central Banks, which clearly realize that economic recovery will be much more difficult in the face of currency appreciation. One analyst argues that, “Until the signs of global economic recovery become more convincing, central banks will unlikely tolerate significant currency appreciation.” The Central Banks of South Korea, Taiwan, and Indonesia have already actively intervened to hold their currencies down, while Malaysia and Singapore (discussed in a Forexblog post last week) have also intervened for the sake of stability.

As a result, this rally could soon begin to lose steam. “A ‘correction’ in regional currencies is ‘appropriate’ following recent gains,” said one analyst. Another has called the rally “overdone.” Still, Central Banks and economic data pale in comparison to capital flows and risk/reward analysis. In short, these currencies (and other investments) will continue to find buyers for as long as there are those hungry for risk. Citigroup, whose “Asia-Pacific foreign-exchange volume may rise about 10 percent from the first quarter,” is bullish. A representative of the firm declared: “Fund managers are still ’sitting on lots and lots of cash’ so the pickup in volumes will continue.”

Euro Continues to Rise, but Technical Obstacles Exist

Over the last couple months, the Euro has thoroughly outperformed the Dollar, which recently fell to a five-month low on a trade-weighted basis. Over the same period, global stock and commodity prices have also risen quickly, which is not a coincidence. In other words, investors are allocating capital on the basis of risk, rather than in accordance with (economic) fundamentals. For example, “ICE’s Dollar Index and crude oil have a correlation of minus 0.61 in the past two months, compared with minus 0.26 since the start of the year,” as rising oil prices and the declining Dollar feed back into each other.

In other words, investors are allocating capital on the basis of risk, rather than in accordance with (economic) fundamentals. For example, “ICE’s Dollar Index and crude oil have a correlation of minus 0.61 in the past two months, compared with minus 0.26 since the start of the year,” as rising oil prices and the declining Dollar feed back into each other.

Meanwhile, “Implied volatility on major currencies, which reflects investors’ expectations of currency swings, fell to 13.96 percent yesterday, from…17.22 percent at the end of March. A drop in volatility tends to signal less demand for options to protect investors from currency swings.” This indicator is now at its lowest level since the days preceding the Lehman Brothers bankruptcy and subsequent stock market collapse. One would normally expect a correlation between risk and return, but in this case, rising returns have been accompanied by lower risk.

Even more unbelievable is that this decline in risk is taking place against the backdrop of declining economic fundamentals. “Risk appetite in the currency market is nothing short of impressive considering the fact that the Fed reduced their growth forecasts,” said one analyst. However, “The euro-area economy will contract 4.2 percent this year, according to the International Monetary Fund, more than the projected 2.8 percent contraction in the U.S. and 4.1 percent slump in the U.K.” If investors were focusing on this divergence in economic growth, one would expect the Euro would be falling.

One hypothesis is that inflation-conscious traders are flocking to the Euro, since the ECB remains vigilant about fighting inflation, even in the face of declining prices and aggregate demand. After cutting rates to a record low 1% earlier this month, the ECB unveiled its own version of a quantitative easing plan, involving the purchase of 60 billion euros worth of low risk securities. But this is a pittance, both relative to the size of the EU economy (it represents a mere .6% of GDP) and compared to the Trillion Dollar Fed program. This led one analyst to call the ECB’s plan “chicken feed.” While all of this is noteworthy, it’s unlikely that this is having a meaningful effect on forex markets, which still remain focused on (avoiding) deflation.

If the Euro is to continue rising, it must overcome some technical obstacles. “The euro could hit a ceiling if the recent resilience of U.S. stock markets faces headwinds. ‘At some point…stronger nongovernment growth has to show up to sustain and justify these moves in equities.’ ” It’s interesting that the fear of Euro bulls is not that the EU economy won’t recover, but rather that US stock prices are overvalued. Given recent market movements, however, their concerns are reasonable, and “any disappointment [in corporate fundamentals] could provide an excuse to take profit [this] week — benefiting the dollar.”

Electronic forex trading rose 37% in 2008 – Greenwich Associates

Tuesday, May 12, 2009

Investors seem to have flocked into electronic forex trading in a quest for liquid markets, as a recent research by Greenwich Associates shows a 37% increase on electronic trade, outpacing the 13.0% increase in total FX Trading Volume.

The proportion of global forex trading executed through electronic devices has increase, thus, to 53% in 2008 from 44% in 2007.

Wall Street falls for second day on financials and automakers down, USD weakens

Down jones is falling 0.42% so far today, Nasdaq drops 1.81%, NYSE is declining 0.88% and the S&P 500 is flirting with the 900 pts level as it is losing 0.89% so far today.

After reaching 7-week high at 1.3707, the EUR/USD has fallen around 100 pips to test the 1.3600 level. The pair has lost almost all it initial daily gains and currently the pair is rising 0.10% so far today from opening price.

GBP/USD is rising 0.70% so far today and it is trading around 1.5230 after reaching 4-month high at 1.5330. USD/JPY has reached a fresh May low at 96.35 after falling 150 pips from 97.85, intra-day high in the early European session. Currently the pair is falling around 1.20 so far today from 97.60 opening price action to the currently 96.45.

USD/CHF is testing the 1.1090 resistance level, but it remains in the down field, currently the pair is falling 0.20% so far today from opening price.

"U.S. data also come out better than expected, as Trade deficit widen less than expected to -27.6B. Wall Street opened to the upside, but was unable to hold gains and fell sending a mixed message after a two-month rally. Euro and Gbp continued firming up, although far from early highs. Euro now at 1.3646 from 1.3707, and Gbp 1.5251 from 1.5352. As we have been mentioning, currencies are tending to detach from stocks, yet process is just beginning. Keep an eye on stocks, but don’t ignore self situation for each currency. Expect some correction and consolidation before majors resume bullish trend against dollar."

Foerx: USD/JPY drops quickly to test 96.00

USD/JPY is dropping to 96.00: "Price action on USD/JPY has been dropping substantially since last Friday after hitting strong resistance in the 99.55-99.75 price region. This bearishness has pushed price all the way down to approach strong support around the key 96.00 level"

GBP/USD rebounds from 1.5200 to 1.5265

GBP/USD is still rebounding from 1.5200 and has been rising in the last hours. Even though the pair is 110 pips below today high at 1.5352 which is also a 4-month high. Next resistance levels lies at 1.5265; 1.5310 and 1.5335. On the downside supports could be found at 1.5220 and 1.5195 (below session lows). Current price is 1.5255 or 0.88% above opening price.

Dollar losses steam against European currencies

EUR/USD actual price is 1.3640 or 0.45% above opening price. The pair reached a session low at 1.3587 but the Dollar couldn’t hold below 1.3600. Next resistances are at 1.3650 and 1.3680. Support could be found at 1.3625; 1.3605 and 1.3585.

The pound also rose against the Dollar in the last hours. Recently GBP/USD broke above 1.5265 resistance zone to 1.5285. USD/CHF failed to consolidate above 1.1080 falling to 1.1050 which now is a key support.

Wall Street ends mix, Dollar down

EUR/USD is up for the day 0.51%. But the dollar recovered after the pair reached a new 7-week high at 1.3707 falling to 1.3588, but failed to stay below 1.3600. Current price is 1.3643.

USD/CHF reached a 4-month low at 1.1005 early in the day. But during the American session the dollar recovered some losses topping at 1.1090. Currently the pair is moving in a range between 1.1050 and 1.1070.

The pound rose against the dollar today but couldn’t hold all its gains during the American session. GBP/USD reached today a 4-month high at 1.5352 after U.S. trade data was released. Then fell bottoming at 1.5200 where the pound rebounded and strengthen rising to 1.5285. Current price is 1.5265 which is 1% above opening price.

Asian markets rise on corporate earnings; Euro and Pound steady at mid-term highs

Japanese Nikkei Index adds 0.7%, and the Hong Kong Hang Seng Index rose another 0.7%, markets in Australia, New Zealand and India are going through losses.

Olympus rose 12% on the back of a company earnings forecast of 40 billion Yen, against 9.3 billion Yen loss expected by market analysts. Nissan rose 6.5% after forecasting a net loss for the year 2009, half the amount expected by the analysts.

Euro and Pound steady at high levels; Dollar Yen, lower

EUR/USD has entered into a consolidation phase ranging from 1.3660 to 1.3720, fresh 7-week high reached on Asian session. The Euro lies right below Mar 19 high at 1.3740.

GBP/USD remains hovering below the fresh 4-month high at 1.5350 reached on Monday’s U.S. session, right below1.5370 (Jan 8 high). At the moment, the Pound moves in a narrow range both sides of 1.5300.

USD/JPY has continued with its decline from May 8 high at 99.66, and the Dollar has reached a fresh 2-week low at 95.75 to pick up to levels above 96.00 at the time of writing.

Sterling continues Bullish trend

Bigger time frames also seem a bit exhausted yet, no other signs of reversal yet.“Expect more gains in the pair, as long as price remains above the 20 SMA.”

Euro jumped higher

“Overall the EUR/USD traded with a low of 1.3563 and a high of 1.3709 before closing at 1.3650,”

USD/JPY Current Price 95.96

Pair has no signs of exhaustion or reversal and indicators Pair now should attempt to reach next important support at 95.50, that probe it’s strength in the past. “Seems unlikely the pair breaking under at a first attempt,” If surpassed, longer term perspective lies at 93.30 zone.

Pacific currencies appreciation limited

Australian dollar continues to be favored by rising gold prices thus appreciation should remain limited by recent highs around 0.77. RBA and Australian government are forecasting the worst budget deficit since WWII for 2009/10, and seems unlikely government to have much scope to take it further into deficit over the year ahead.

Forex: Yen rises across the board

GBP/JPY current price is 147.18. The pair tested today a key support area at 146.30. Next support levels to consider are located at 145.60 (May lows) and 144.85. On the upside the pair has topped at 149.50. A break of the line could take the pair to the next resistance zone at 150.85 (one-month high)

Against the euro the Yen rose for second consecutive day. EUR/JPY rebound at 130.70 to 131.50. The pair has moving in a downtrend after reaching a one-month high at 134.80 Monday morning.

Euro Goes Down, Yen Strengthens as Stocks Pared Gains

Monday, May 11, 2009

The euro fell for the first time since May 7 against the U.S. dollar, while the Japanese yen rose against all other major currencies, as the European stock markets failed to demonstrate a commitment to move farther up.

The euro fell for the first time since May 7 against the U.S. dollar, while the Japanese yen rose against all other major currencies, as the European stock markets failed to demonstrate a commitment to move farther up.Euro consolidating inside a triangle

USD/JPY breaks below 97.95

“Initial resistance is at 97.75 and key resistance is located at 98.50, above this level will indicate that a short term cycle bottom has been formed and the fall from 99.64 has completed,”

GBP/USD Current price: 1.5109

First static support will come at the 1.5090 zone, where we have a short term ascendant trend line coming from 1.4942 low. “However, bigger support lies not at 1.5060, longer and stronger ascendant trend line in the daily,” said Valeria Bednarik, collaborator at FXstreet.com. Clear break under that zone, will bring more downside pressure for the pair.

Euro GDP could tumble on Q1

Minor data published earlier in the euro zone, has turned into a key factor for the most traded currency of the world: early Tuesday, French and Italian Industrial Production slumped to record lows in March, suggesting euro zone economic contraction in these first three months of the year could be the worst on record. Italian industrial output fell 24%, while French industrial production fell 16% over the past month. Euro zone GDP for the first Q1 to be release next May 15, is forecasted to contract for the fourth straight quarter, this time at a rate of -2.0 percent, compared to -1.6 percent in Q4 2008, while the year-over-year rate could fall by a whopping 4.1 percent. Such reading will indicate that recession continued deepening this first quarter of the year, and could probably signal losses ahead for Euro.

Wall Street fell on profit-taking; Dollar rose across the board

EUR/USD after fighting at 1.3600 fell broking support at 1.3580. Current price is 1.3474 down 0.58% from opening price. Next support zone lies at intra-day low at 1.3555 next level to consider is 1.3535.

The pound also weakened to the dollar for the day. During the American session GBP/USD was able to recover part of early losses but failed to break resistance at 1.5170 and has fallen since then. Actual price is 1.5103. So far today GBP/USD falls 0.83%.

USD/CHF rose today after reaching a new 4-month low at 1.1020 during the Asian Session. The recovery of dollar against the Swiss Franc reached an intra-day high at 1.1104 near current price. The pair is now testing resistance zone at 1.1105.

The dollar also got stronger against commodities currencies. AUD/USD fell below 0.7600 after moving in a downtrend all day. USD/CAD rallied today from 5-month lows at 1.1460 to 1.1672.

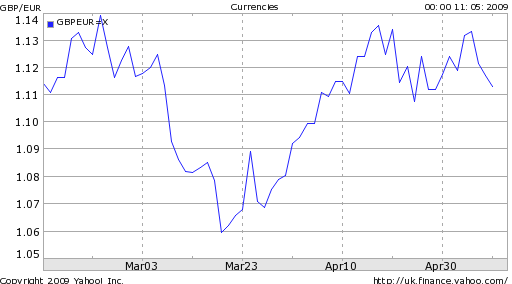

Pound Sterling Trends Downward as BOE Expands QE

The Pound is holding its own against the USD, even touching a four-month high last week. But against other major currencies, the story is just the opposite. While managing to avoid parity against the Euro, for example, the Pound has nonetheless remained range-bound against the common currency. The Australian Dollar, meanwhile, has risen to $2 against the Pound for the first time in 13 years.

How to explain the stagnation of the Pound? It depends on which currency pair you look at. Against the Dollar, the narrative remains one of risk aversion; when stocks rise, so usually does the Pound. “The U.K. pound is joining other currencies in beating up on the dollar,” announced one analyst on a day that stocks and commodities rallied broadly. The Pound has also been able to hold its own against the Dollar because both currencies’ Central banks have embarked on similar quantitative easing plans, which could prove equally inflationary in the long run. [Chart courtesy of Economist].

In fact, the Bank of England just announced a huge expansion in its program, increasing total debt buying (i.e. money printing) by $50 Billion. One analyst summarized the impact of this announcement on forex markets as follows: “The Bank of England’s aggressive stance with regard to quantitative easing is adding to concern about the economy and that is negative for sterling.” Not much nuance there….

In fact, the Bank of England just announced a huge expansion in its program, increasing total debt buying (i.e. money printing) by $50 Billion. One analyst summarized the impact of this announcement on forex markets as follows: “The Bank of England’s aggressive stance with regard to quantitative easing is adding to concern about the economy and that is negative for sterling.” Not much nuance there….

In fact, this is especially bad for the Pound against the Euro, where a juxtaposition of the Central Banks’ respective approaches to the credit crisis reveals stark differences: “The weakness in the pound suggests the market is drawing a contrast between the ECB, which seems to be dragging its legs on quantitative easing, and the BOE, which is still ‘full-steam ahead.’ ” Where the ECB is providing liquidity indirectly in the form of swaps and guarantees, the BOE is printing money and injecting it right into capital markets.

“Mervyn King, governor of the Bank of England, has said the exit strategy will be dictated by the outlook for inflation and that central banks should not support markets that cannot survive on their own,” but investors remain skeptical and for good reason. “Britain will sell a record 220 billion pounds of gilts this fiscal year, 50 percent more than last year.” Based on the fact that yields have risen for four straight weeks (against the backdrop of the first “failed” auction ever for UK government bonds), there is doubt that the government can finance its deficits.

The BOE continues to be roundly smacked with criticism, for its role in fomenting the credit crisis and in not adequately responding to it: “It happens that in the early years of inflation targeting, it did produce a stable economy. But I think it’s now clear that it can’t, by itself, produce a stable economy,” argued one commentator. Unemployment rates in the UK remain at frighteningly high levels. The government’s own economists (which aremore optimistic than third-party forecasts) forecast GDP at -3.5% for 2009, with a modest recovery in 2010. Of course, these forecasts should be taken with a grain of salt, as they hinge on the crucial assumption that the BOE’s interest rate cuts and quantitative easing plan will soon trickle down through the economy, proof of which has still not been observed.

As a result, I’m personally between neutral and bearish for the UK Pound. For as long as stocks continue to rally, investors will remain Adistracted. If and when the rally loses steam (I am skeptical that the rally is sustainable), they will quickly turn their attention to comparative economic and monetary conditions; suffice it to say that Pound won’t stack up well.

WisdomTree Unveils New Multi-Currency ETF

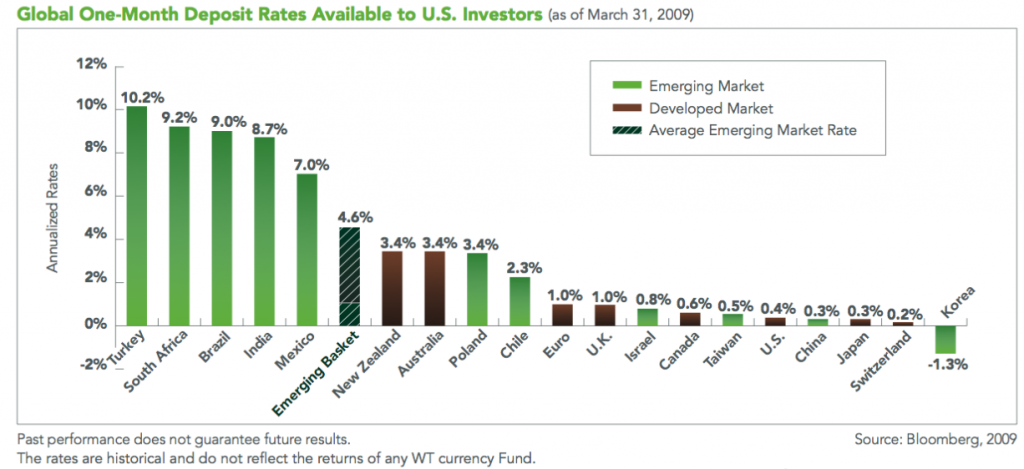

On Wednesday, the latest addition the Wisdom Tree family of currency ETFs officially debuted, and in its first two days of trading, the Emerging Currency Fund (CEW) returned an impressive 2.2%. It’s not worth annualizing this figure, but suffice it to say that its performance is already turning heads.

According to the prospectus, CEW “is an actively managed exchange-traded fund that seeks to provide the investor with a liquid, broad-based exposure to money market rates and currency movements within emerging market countries.” Investors will gain exposure both to the currencies themselves and to their respective short-term interest rates, via “short-term U.S. money market securities and forward currency contracts and swaps of the constituent currencies…designed to create a position economically similar to a money market security denominated in each of the selected currencies.”

Chosen from three regions (Latin America, Africa/Europe/Middle East, and Asia), the inaugural 11 currencies are as follows: Brazilian real, Chinese yuan, Chilean peso, Indian rupee, Israeli shekel, Mexican peso, Polish zloty, South African rand, South Korean won, Taiwanese dollar and Turkish new lira. According to WisdomTree, these currencies were selected not necessarily for economic reasons, but rather because of their relatively high liquidity and low correlation with each other. In addition, “The selected currencies are equally weighted in terms of dollar value at each currency assessment date and after each quarterly re-balancing,” to reflect fluctuations in exchange rates. Naturally, WisdomTree reserves the right to rejigger the portfolio in terms of constituent makeup, but this would probably only be effected to improve overall liquidity, rather to replace an under-performing currency.

Chosen from three regions (Latin America, Africa/Europe/Middle East, and Asia), the inaugural 11 currencies are as follows: Brazilian real, Chinese yuan, Chilean peso, Indian rupee, Israeli shekel, Mexican peso, Polish zloty, South African rand, South Korean won, Taiwanese dollar and Turkish new lira. According to WisdomTree, these currencies were selected not necessarily for economic reasons, but rather because of their relatively high liquidity and low correlation with each other. In addition, “The selected currencies are equally weighted in terms of dollar value at each currency assessment date and after each quarterly re-balancing,” to reflect fluctuations in exchange rates. Naturally, WisdomTree reserves the right to rejigger the portfolio in terms of constituent makeup, but this would probably only be effected to improve overall liquidity, rather to replace an under-performing currency.

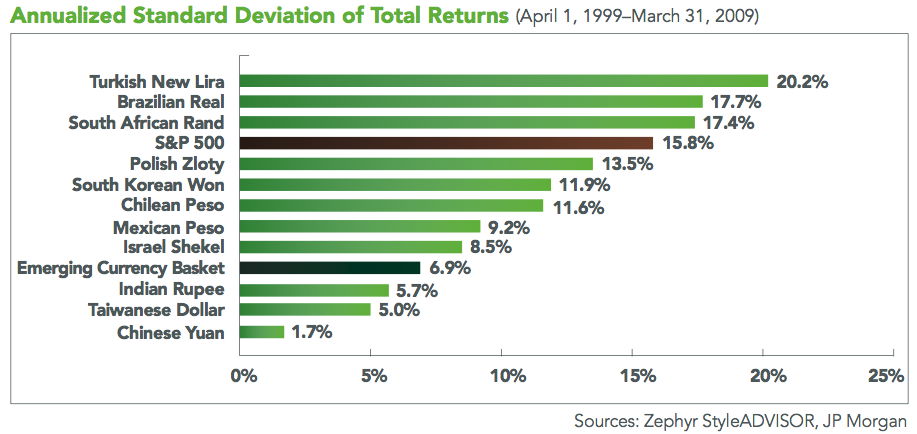

The advantage of CEW lies in its automatic diversification, such that investors gain access to a variety of currencies but only have to transact in the fund itself. WisdomTree also points out that, “Emerging market currencies often move independently of domestic stock, bond and money market investments…[and] exhibit low correlations to other alternative asset classes, such as commodities and gold.” The chart below [courtesy ofCEW promotional materials] makes this point indirectly, and it probably comes as a surprise that US stocks are collectively more volatile than individual emerging market currencies. “Incorporating a 10% allocation of emerging currency into balanced portfolio mixes of the domestic stocks and domestic bonds over the last ten years…raised annual returns by an average of 0.66%, while lowering overall portfolio volatility” in a hypothetical exercise.

“In terms of taxation, WisdomTree says normal capital gains rules will apply to the sales of fund shares. However, income from the portion of the fund invested in U.S. money market securities usually will be taxed as ordinary income, while the tax treatment of the local currency forward contracts could vary with the situation.” The fund’s expense ratio, meanwhile, is .55%.

If the preceding paragraphs read like a sales pitch, I apologize, as that was not my intention. At the same time, I’m personally quite positive about CEW (as well as ETFS in general, for that matter), since it provides quick and easy exposure to a bunch of quality currencies, eliminating the need to buy them separately. Not to mention that this fund is debuting right when both the carry trade and emerging markets (and their currencies) are coming back in vogue.

I’m not sure if the timing was deliberate, but it could certainly have been worse. It’s tough to say whether the market rally of the last two months is sustainable, but if the decline in risk aversion that ignited the rally continues to obtain, it will be good for CEW.

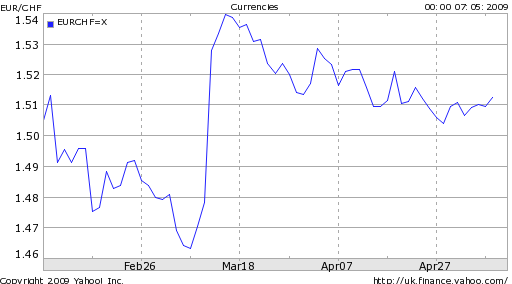

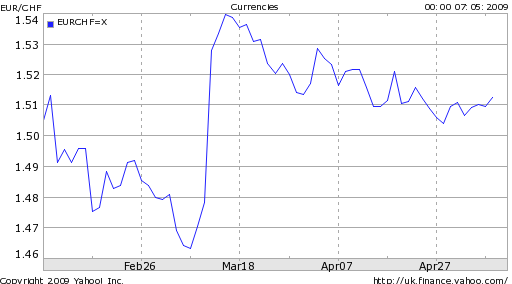

Swiss National Bank Renews Threat of Intervention

When the Swiss National Bank (SNB) announced oln March 12 that it would intervene in forex markets for the first time since 1994, the Franc immediately plummeted up to 5% against select currencies. Since then, the currency has largely clawed back some of its losses, prompting talk of round two: “Speculation about animminent intervention in the foreign-exchange markets was rife…after the euro fell to CHF1.5031, the lowest level seen since March 12 when the SNB began selling Swiss francs against euros.”

It was unclear whether the Central Bank had chosen a magic threshold, such that a rise by the Franc above which would trigger a sale of Francs in the open market. Earlier in the week, one analyst asserted, “With the euro/franc exchange rate almost at pre-intervention levels - the euro jumped to a level above CHF1.52 after the SNB intervention in March from CHF1.4843 before the announcement - the stage is set for the SNB to either put up or shut up.”

It was unclear whether the Central Bank had chosen a magic threshold, such that a rise by the Franc above which would trigger a sale of Francs in the open market. Earlier in the week, one analyst asserted, “With the euro/franc exchange rate almost at pre-intervention levels - the euro jumped to a level above CHF1.52 after the SNB intervention in March from CHF1.4843 before the announcement - the stage is set for the SNB to either put up or shut up.”

Sure enough, both the Chairman of the SNB as well as a board member both announced yesterday that the campaign to hold down the the Franc is still in effect, and will soon enter a new phase. Thus far, the Bank has relied on various forms of quantitative easing to deflate its currency, both through direct currency transactions and purchases of bonds. The goal of such quantitative easing is only proximately to deflate the Franc; the ultimate goal is to ward off deflation. Given that the Bank had already lowered its benchmark interest rate close to zero, manipulating its currency was/is one of its few remaining options. “As long as the environment does not improve and as long as deflation risks are visible in our monetary policy concept, we will stick to this insurance strategy resolutely,” said Chairman Jean-Pierre Roth.

As the economic recession takes hold, the Swiss economy is forecast to contract 3% in 2009, but to grow in 2010. Consumer sentiment has fallen to the lowest level since 2003. Inflation, meanwhile is projected at -0.5%; deflation, in other words. Still, Switzerland maintains that its motivation is not to boost the economy, but only to increase monetary stability. National Bank governing board member Thomas Jordan “reiterated the interventions have nothing to do with a beggar-thy-neighbor policy, a strategy to weaken a country’s currency to improve the situation for domestic exporters.”

Given that forex intervention is usually doomed to failure, the SNB must rely on a combination of luck and improved fundamentals to keep the Franc down. Thus, when the next round of intervention was announced yesterday, the Franc fell by a modest .75% against the Euro, as investors largely shrugged of the news. Fortunately, the initial pledge to intervene coincided with a pickup in investor sentiment, and decline in risk aversion. This has reduced demand for the Swiss Franc, which had previously been bid up as a so-called “safe haven” currency. As long as the stock market rally continues, investors will stick to higher-yielding currencies and the Franc should be “safe.”

Australian, New Zealand Currencies Benefit from Risk Aversion

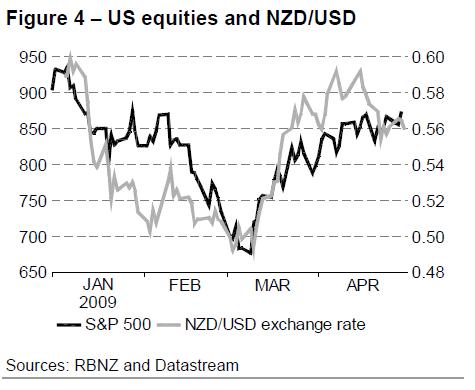

Against each other, the New Zealand Kiwi and Australian Dollar have traded in a pretty tight range for the last year (except for a “blip” in the fall of 2008). This makes sense, as both currencies rise and fall in accordance with exports and interest rates.

Against other currencies, meanwhile, both have torn upwards in the last couple months. Despite steep interest rate cuts, both currencies have maintained their interest rate advantages against other industrialized currencies. This has not gone unnoticed, and the return of the carry trade has been kind. “The current improvement in sentiment is providing an underpinning of support and while that remains the case - and that may be until midyear - the New Zealand dollar is going to remain well-supported,” said one economist.

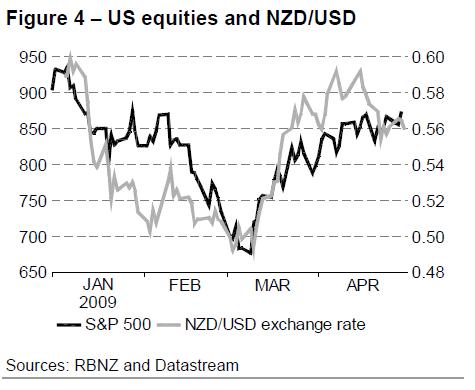

The correlation between the New Zealand Kiwi, specifically, with the US stock market has become remarkably cut-and-dried of late, which you can see from the chart below. For carry traders, therefore, it probably makes more sense to follow stock market commentary than to track New Zealand economic data. The same economist, for example, warned “that the equities rally, which has seen the broad U.S. Standard & Poor’s 500 index climb 36% from its March low after rising another 3.4% Monday to its highest since Jan. 8, may be dissipating.”

Besides, given the deteriorating economics in both countries, lower interest rates are probably inevitable: “We think this case for further cuts will be made in the second half of this year…we think it will be very difficult, no matter what the global economy is doing, for the RBA to ignore rapidly rising unemployment,” offered one analyst who predicted that rates would be cut to a “trough of 2%.” In such a scenario, the interest rate spread would still remain healthy, but perhaps not enough to offset the additional risk.

Australian home prices are falling at a rapid clip, the labor market is sagging. In New Zealand, meanwhile, a decline in sentiment and consumer spending has corresponded with a 1% contraction in GDP in the quarter ended March 31. Tourism is down, although net exports are increasing. The current account deficit continues to expand, but this is mostly a product of an investment balance - perhaps related to the carry trade.

For now, forex traders remain optimistic, albeit slightly less so than before: “The difference in the number of wagers by hedge funds and other large speculators on an advance in the Australian dollar compared with those on a drop — so-called net longs — was 16,692 on April 28, compared with net longs of 17,250 a week earlier.”

US Initial Jobless Claims drop bu 34K to 601K in May 2 week

Friday, May 8, 2009

US Initial Jobless Claims drop 34K to 601K in May 2 week

Forex: EUR/USD: Euro reaches intra-day high at 1.3380 after ECB monetary policy decision

If the Euuro manages to hold above 1.3375 (May 6 high), next resistance level might lie at 1.3435 (May 5 high) and 1.3460/65. On the downside, support levels might be at previous intra-day high 1.3345 and below there, 1.3290/1.3300 and 1.3255/45 (intra-day low/may 6 low).

EUR/JPY has rally from 130.70 has extended after ECB decision to levels right below 132.80/90, May 4 and 5 high. Resistance levels lie at the mentioned 132.80/90, and above there, 134.33. Support levels lie at 132.40 and 132.00.

Forex: EUR/GBP rise above 0.8860 after ECB Cuts Benchmark Interest Rate

The European Central Bank Monetary Policy Committee has decided to trim its key interest rate by 25 basis points to 1.0% after its May monetary policy meeting.

ECB cuts Refi Rate by 25 bps to 1.0%; Euro jumps to intra-day high

The European Central Bank, as usual did not give any further explanation, so all the eyes are set on the press conference Mr. Trichet will hold later at 12.30 GMT.

EUR/USD has broken intra-day high jumping from levels at 1.3300 to levels above 1.3360, approaching May 5 high at 1.3375, immediately after the Bank published its decision.

Forex: EUR/GBP rises above 0.8820 after BoE monetary policy decision

of hold unchanged its interest rate at 0.50%, decision was in line of expectations. EUR/GBP climbed up from 0.8790 to reach 0.8855, intra-day high. Currently the pair is trading around 0.8820/30, 0.40% above today's opening price.

The Bank of England has decided to leave its official bank rate unchanged at 0.5%at its May monetary policy meeting and to continue with the program of asset purchases financed by the issuance of central bank reserves and increase its size by GBP50 billion to a total of GBP125 billion.

GBP/USD: Pound drops to 1.5050 after BoE monetary policy decision

On the downside, if the Pound consolidates below 1.5070 previous intra-day low, next support level could come at 1.4980/90 (May 6 low); below there, 1.4945 (Apr 30 high). On the upside, resistance levels remain at 1.5165 (May 5 high) and above there, 1.5200 intra-day high and 1.5370.

GBP/JPY has also dropped on the back of BoE’s monetary policy announcement, and the Pound declined from 150.90 to 149.30 although the Pound seems to be picking up to levels around 150.00. Resistance levels lie at 151.50 and 151.75. Support levels lie at 149.90 and 149.60.

Forex: GBP/JPY falls below 149.50 after BoE rate decision

The Bank of England has decided to leave its official bank rate unchanged at 0.5%at its May monetary policy meeting and to continue with the program of asset purchases financed by the issuance of central bank reserves and increase its size by GBP50 billion to a total of GBP125 billion.

BoE leaves Bank Rate unchanged at 0.5%; GBP plunges

The Pound has dropped sharply after the Bank released its decision, from levels around 1.5160, the Pound has lost about 100 pips i a matter of minutes, dropping to levels below intra-day low at 1.5070.

Forex: GBP/USD reacts down after BoE monetary policy decision, below 1.5100

BoE leaves its interest rate steady at 0.5%

BoE leaves its interest rate steady at 0.5%

Forex: EUR/USD: Euro reaches 1.3345 intra day high ahead of ECB

The Euro will weaken after ECB publishes its monetary policy: “On a mild recovery path this European morning, the pair is currently trading at 1.3300 from lows around 1.3250. We see some more of this recovery move coming before the ECB’s publication of its monetary policy, but then a turn downwards around the 1.3330 level, bringing the market back to its today’s lows at 1.3250.”

Resistance levels lie at 1.3345/55 area (Intra-day high) and above there, 1.3375 (May 6 high) and 1.3435 (May 5 high). On the downside, support levels lie at 1.3280 and 1.3250 intra-day low, below there, next support could be at 1.3210 (May 4 low).

European markets rise as confidence in Banks return; Euro and Pound, up

Eurostoxx 50 Index adds 1.75%, while German DAX Index rises 1.71% and the French CAC trades 1.90% above its opening level. In England, London FTSE Index rises 2.25%.

On the macroeconomic side, German Factory orders jumped unexpectedly in March; 3.3% up against a 0.5% decline forecasted by market experts.

Euro and pound appreciate; Yen weakens

EUR/USD has appreciated during European session, after bouncing at 1.3250 intra-day low, the Euro has risen to levels above 1.3300 reaching intra-day high at 1.3344 after the release of German factory orders.

GBP/USD has jumped from 1.5070 low on early European session breaking 1.5165 resistance level, to reach a new 4 month high at 1.5195: At the moment the pair trades at 1.5155 level ahead of the BoE monetary policy decision.

USD/JPY has rallied during European trading times from 98.40 low to 9945 high, to pull back later to levels around 99.20.

Forex: GBP/USD: Pound breaks above 1.5165; fresh 4-month high

Next resistance level remains at 1.5190, and above there, 1.5370 (Jan 8 high) and then 1.5725 (Dec 17 high). On the downside initial support comes at 1.5165 and below there, 1.5100 and 1.5065.

Germany Factory Orders rise 3.3% in Mar, -26.7% YoY

Germany Factory Orders rise 3.3% in Mar, -26.7% YoY

Forex: GBP/USD: Pound returns above 1.5100

On the way up, resistance levels lie at the mentioned 1.5165 (May 5 high) and above there, 1.5190 and then 1.5370 (Jan 8 high). On the downside, 1.5065 (Apr 16 high) and 1.4980/90 (May 6 low); below there, 1.4945 (Apr 30 high).

GBP/JPY recovery from 146.95 low yesterday has extended on European session above 150.00 on rally from levels above 149.00. Next resistance levels lie at 151.50 and 151.75. Support levels lie at 149.90 and 149.60.

Forex: USD/JPY: Dollar at 99.20 resistance

In case of successful move above here, the Dollar would get on the path to 99.60 resistance (May 1 and 4 high) and above there, 99.70/75 (Mar 5, Apr 17 high). On the downside, support levels remain at 98.35/40 intra-day low and below there, 98.20 and 97.95 (May 6 low).

EUR/JPY has risen from 130.70 support level and the Euro reaches levels close to 13200 at the moment of writing. Resistance levels lie at 132.00/15 and 132.42. On the downside, support levels stand at 130.55 and 129.85.

Forex: GBP/USD: Expect a breakout higher this week, says Mizuho

A break higher is imminent: “Consolidating at the very top of this year’s trading band and because we have held in such a tiny range for the last two days a break higher is imminent. Expect another squeeze higher this week and maybe all month, increasing as more currencies start seriously pulling in the same direction.”

Concerning strategy, advices to go long at 1.5145: “Buy at 1.5145; stop below 1.4800. Add to longs on a sustained break above 1.5175 for 1.5375 short term and then 1.5725/1.5800.”

Forex: USD/JPY: Dollar will climb to 110.00 by year end; National Bank Financial

The National Bank Financial technical analysis team forecasts the Dollar uptrend to extend above 100.00,to reach 102.00 at the end on the second quarter of the current year and continue appreciating throughout the rest of the year.

USD/JPY will reach levels around 105.00 by the end of the 3rd quarter and rush to 110.00 by year end, according to National Bank Financial Forecasts.

Furthermore, NBF sees the Dollar rally to continue through next year, reaching levels around 115.00 in the first quarter and 118.00 in the second quarter of 2010.

Forex: EUR/USD: Euro returns above 1.3285

On the upside, the Euro might find resistance at 1.3325 current day-high, and above here, next resistance levels remain at 1.3350 congestion area and above there, 1.3375 (May 6 high). On the downside, below 1.3285/75, next support levels remain at 1.3245 (May 6 low) and 1.3210 (May 5 low).

EUR/JPY has risen from 130.70 support level and the Euro reaches levels close to 13200 at the moment of writing. Resistance levels lie at 132.00/15 and 132.42. On the downside, support levels stand at 130.55 and 129.85.

Forex: AUD/USD: The Aussie remains steady above 0.7500

The Aussie is aimed now at 0.7675: “The Aussie dollar managed to breach above the key resistance at .7475 and next objective is now aimed at .7675, the bottom of 2007. Upside will most likely remain favored on a short-term basis as both daily and medium term studies are bullish. Intra-day momentum is positive as well and potential pullbacks may be limited by support at .7475 - previous resistance.”

Next resistance level remains at 0.7560 and above there, 0.7600 and 0.7675. On the downside, the Aussie might find support at 0.7475 and below there, 0.7445/50 and 0.7420.

Forex: EUR/USD: Euro weakens further; approaching yesterday’s low at 1.3245

According to Carol Harmer, technical analyst at Charmer Charts, failure to break double top formation yesterday, has left the Euro pointing downwards: “Buyers failed to make headway yesterday thus leaving the double top in place on the short term charts. This has left the market looking weaker with 1.3215 /1.3200 looking to entice. Here sellers would be looking to take profits and buyers will be interested as this is the short term 50% fib level.”

Furthermore, Harmer expects 1.3200 level to hold: “Expect then this support to hold. Buyers then need to take this back above 1.3360/74 to take off downward pressure and lead this higher to 1.3440 once more.”

Forex: GBP/USD: Pound tests 1.5085 daily pivot

If the Pound breaks below 1.5085, Tim Salem, collaborator at FXstreet.com forecasts the following levels to observe: “Depreciation through the Daily pivot at 1.5085 sees 1.5054 Daily Static Support followed dynamically by 1.5014. Slight Bearish Sentiment will return on the IntraDay View with 1.4976/53 Support Areas being seen, as potential RSI Readings below the “40’s” will begin to Shape and Confirm the Bias.”

Support levels remain at 1.5065 (Apr 16 high) and 1.4980/90 (May 6 low), below there, 1.4945 (Apr 30 high). On the upside, recovery from current levels could face resistance at 1.5155/60 (intra-day high/ May 5 high), and above there, next resistances could be at 1.5190 and then 1.5370 (Jan 8 high).

Switzerland Apr CPI rises 0.9% on month, -0.3% on year

Switzerland Apr CPI rises 0.9% on month, -0.3% on year

Australian Dollar Hits 7-month High on Favorable Employment Data

The Aussie rose against the yen after a regional jobs report in Australia showed an increase in employment conditions and data.

The yen had a day of losses against the main currencies in Oceania, after continuous evidences that the global financial situation may be improving, pushing investors towards high-yielding assets and decreasing the risk aversion sentiment on equity markets. In Australia, after a report showing gains on regional employment, doubts on whether the national interest rates shall have further cuts were lifted, making the Aussie to hit a 7-month high against the weakening yen. The kiwi followed the Australian dollar, and posted gains against the Japanese currency after better-than-expected unemployment numbers were released.

Risk appetite is growing in Asian markets, which will certainly bring investors to buy Australian assets, according to experts. Since last week, when concerns that the swine flu would deepen the recession ended, the global markets witnessed the sharpest rally since the global slump started last year, with investors leaving refuge currencies such as the yen and the Swiss franc to buy stocks and currencies like the Aussie. Analysts also indicate that a recovery in commodity prices may bring the Australian dollar to higher levels.

AUD/JPY rose sharply from 72.88 to 75.08, NZD/JPY followed, rising from 57.22 to 58.87. EUR/AUD fell from 1.7950 to 1.7604.

Euro Rises Slightly After ECB Interest Rate Cut

Thursday, May 7, 2009

The euro had a slight rise against the dollar after the European Central Bank cut its benchmark interest rate to 1 percent, a record low for the European economic bloc.

The speculations that the ECB would cut its rates were confirmed today after the European policy makers set the interest rate to 1 percentin the Eurozone, an effort to avoid the current severe recession to deepen. After the ECB statement, traders are focusing to watch Jean-Claude Trichet’s declarations on what kind of measures will be taken to ease the economic crisis in the region. The euro posted gains against the dollar and the yen, as risk appetite grows, but also against the pound, which was previously rallying against the European common currency.

Analysts are expecting the euro to strengthen if unconventional measures from the ECB will be taken in order to revive the bloc’s economy. It is highly possible that quantitative easing will be considered in the Eurozone, and as some ECB council members have stated, the central bank is likely to buy debt to increase the amount of money in the economy. Even if the euro is likely to strengthen, a certain amount of unpredictability surrounds the future of the euro currency pairs.

The EUR/USD currency pair traded at 1.3348 rising from 1.3305 in the intraday comparison. EUR/GBP remained stable fro yesterday’s price, as it reversed a downtrend after the ECB rate cuts.

Swiss National Bank Renews Threat of Intervention

When the Swiss National Bank (SNB) announced oln March 12 that it would intervene in forex markets for the first time since 1994, the Franc immediately plummeted up to 5% against select currencies. Since then, the currency has largely clawed back some of its losses, prompting talk of round two: “Speculation about animminent intervention in the foreign-exchange markets was rife…after the euro fell to CHF1.5031, the lowest level seen since March 12 when the SNB began selling Swiss francs against euros.”

It was unclear whether the Central Bank had chosen a magic threshold, such that a rise by the Franc above which would trigger a sale of Francs in the open market. Earlier in the week, one analyst asserted, “With the euro/franc exchange rate almost at pre-intervention levels - the euro jumped to a level above CHF1.52 after the SNB intervention in March from CHF1.4843 before the announcement - the stage is set for the SNB to either put up or shut up.”

It was unclear whether the Central Bank had chosen a magic threshold, such that a rise by the Franc above which would trigger a sale of Francs in the open market. Earlier in the week, one analyst asserted, “With the euro/franc exchange rate almost at pre-intervention levels - the euro jumped to a level above CHF1.52 after the SNB intervention in March from CHF1.4843 before the announcement - the stage is set for the SNB to either put up or shut up.”

Sure enough, both the Chairman of the SNB as well as a board member both announced yesterday that the campaign to hold down the the Franc is still in effect, and will soon enter a new phase. Thus far, the Bank has relied on various forms of quantitative easing to deflate its currency, both through direct currency transactions and purchases of bonds. The goal of such quantitative easing is only proximately to deflate the Franc; the ultimate goal is to ward off deflation. Given that the Bank had already lowered its benchmark interest rate close to zero, manipulating its currency was/is one of its few remaining options. “As long as the environment does not improve and as long as deflation risks are visible in our monetary policy concept, we will stick to this insurance strategy resolutely,” said Chairman Jean-Pierre Roth.

As the economic recession takes hold, the Swiss economy is forecast to contract 3% in 2009, but to grow in 2010. Consumer sentiment has fallen to the lowest level since 2003. Inflation, meanwhile is projected at -0.5%; deflation, in other words. Still, Switzerland maintains that its motivation is not to boost the economy, but only to increase monetary stability. National Bank governing board member Thomas Jordan “reiterated the interventions have nothing to do with a beggar-thy-neighbor policy, a strategy to weaken a country’s currency to improve the situation for domestic exporters.”

Given that forex intervention is usually doomed to failure, the SNB must rely on a combination of luck and improved fundamentals to keep the Franc down. Thus, when the next round of intervention was announced yesterday, the Franc fell by a modest .75% against the Euro, as investors largely shrugged of the news. Fortunately, the initial pledge to intervene coincided with a pickup in investor sentiment, and decline in risk aversion. This has reduced demand for the Swiss Franc, which had previously been bid up as a so-called “safe haven” currency. As long as the stock market rally continues, investors will stick to higher-yielding currencies and the Franc should be “safe.”

Australian, New Zealand Currencies Benefit from Risk Aversion

Against each other, the New Zealand Kiwi and Australian Dollar have traded in a pretty tight range for the last year (except for a “blip” in the fall of 2008). This makes sense, as both currencies rise and fall in accordance with exports and interest rates.

Against other currencies, meanwhile, both have torn upwards in the last couple months. Despite steep interest rate cuts, both currencies have maintained their interest rate advantages against other industrialized currencies. This has not gone unnoticed, and the return of the carry trade has been kind. “The current improvement in sentiment is providing an underpinning of support and while that remains the case - and that may be until midyear - the New Zealand dollar is going to remain well-supported,” said one economist.

The correlation between the New Zealand Kiwi, specifically, with the US stock market has become remarkably cut-and-dried of late, which you can see from the chart below. For carry traders, therefore, it probably makes more sense to follow stock market commentary than to track New Zealand economic data. The same economist, for example, warned “that the equities rally, which has seen the broad U.S. Standard & Poor’s 500 index climb 36% from its March low after rising another 3.4% Monday to its highest since Jan. 8, may be dissipating.”

Besides, given the deteriorating economics in both countries, lower interest rates are probably inevitable: “We think this case for further cuts will be made in the second half of this year…we think it will be very difficult, no matter what the global economy is doing, for the RBA to ignore rapidly rising unemployment,” offered one analyst who predicted that rates would be cut to a “trough of 2%.” In such a scenario, the interest rate spread would still remain healthy, but perhaps not enough to offset the additional risk.

Australian home prices are falling at a rapid clip, the labor market is sagging. In New Zealand, meanwhile, a decline in sentiment and consumer spending has corresponded with a 1% contraction in GDP in the quarter ended March 31. Tourism is down, although net exports are increasing. The current account deficit continues to expand, but this is mostly a product of an investment balance - perhaps related to the carry trade.

For now, forex traders remain optimistic, albeit slightly less so than before: “The difference in the number of wagers by hedge funds and other large speculators on an advance in the Australian dollar compared with those on a drop — so-called net longs — was 16,692 on April 28, compared with net longs of 17,250 a week earlier.”

Dollar mix while U.S. markets rise

Wednesday, May 6, 2009

Against the yen is loosing early gains and now USD/JPY is down for the day 0.45%.

To the euro, dollar is stronger but failed twice to break below 1.3270. Now is still fighting at 1.3300 near today opening price at 1.3310.

Cable is testing again the zone of 1.5090. GBP/USD has recovered from early losses at the beginning of the American session.

USD/CHF has risen but mostly moving in sideways without been able to break key levels. The pair current price is 1.1337 which is 0.06% down for the day.

Forex: USD/JPY fails to break above 98.65 falls to 98.25

Recently the yen got stronger after falling below 98.50 to 98.25 which now is an important support zone. The current price is 98.45 which represents 0.50% lower than the opening price.

Forex: GBP/USD rises to test 1.5100 again from 1.5010

"Buying of the Dollar resumed yesterday as equities finished lower and the U.S. economy showed better than expected manufacturing data. Traders are allocating their positions accordingly as the markets prepare to absorb a glut of economic news in the coming days which may create a level of heightened price volatility."

"It seems that the Cable's bullish trend might have reached its end. The daily chart shows that the bullish move which was initiated at the Bollinger Bands' lower boarder, has reached its upper boarder. Also, a bearish cross on the daily chart's Slow Stochastic also suggests that a bearish move is expected. Going short might be the preferable choice today."

Forex: EUR/USD fights 1.3300 level after falling to 1.3270

"Pair has reached the 61.8% retracement of the last down leg, so we could see some consolidation between 1.3330 and 1.3365 before next rally to the upside, supported by clearly bullish momentum. Price is above 20 SMA that is also turning up. New candle opening above previous mentioned 61.8% at 1.3365 will be first signal of continuation in the pair. Support levels: 1.3335 1.3300 1.3276. Resistance levels: 1.3365 1.3394 1.3440."

Forex: USD/CAD lost its initial gains and fights the 1.1750 level

"USD/CAD is in an downtrend directed by 1H exponential moving averages. USD CAD is in a consolidation after the last bearish movement. The volatility is low. Bollinger bands are flat. ForexTrend 4H (Mataf Trend Indicator) is in a bearish configuration. The price should find a resistance below 1,1810 (73 pips). The downtrend should continue to gather momentum. Resistances: 1,1810 - 1,1860. Supports: 1,1720 - 1,1680.

Forex: USD/JPY tests 98.65 support after rejecting 99.00

"Pair is fighting with the tough zone between 99.85 (descendant trend line) and 99.00 maximums and minimums congestion zone, slowly regaining the upside, yet mostly in consolidation mode. Clear break above 99.00/99.10 needs to be seen to see the pair gain bullish momentum, while under 98.45 the downside is exposed again, yet limited by the base of the descendant channel projected around 97.60, not seen today. Support levels: 98.45 98.10 97.60. Resistance levels: 99.00 99.28 99.60.

Forex: USD/CHF rejects 1.1300 support, back above 1.1350

"Bearish pressure remains intact in the pair in bigger time frames, although 1.1240 is a strong static support zone, and must be cleared to see the pair falling in the term. Hourly charts remain also bearish, while under 1.1350 zone, with indicators not clear yet bearish, and price under the 20 SMA. Support levels: 1.1282 1.1240 1.1190. Resistance levels: 1.1350 1.1385 1.1400."

Forex: EUR/USD: Euro dips further, below 1.3300

In case of further decline below 1.3275, next support level could come at 1.3250 intra-day low and 1.3210 (May 4 low). On the upside, initial resistance would be at 1.3300 and above there, 1.3340 and 1.3375, current intra-day high.

Despite the decline, Valeria Bednarik, collaborator at FXstreet.com does not discard another rally: “Pair has reached the 61.8% retracement of the last down leg, so we could see some consolidation between 1.3330 and 1.3365 before next rally to the upside, supported by clearly bullish momentum. Price is above 20 SMA that is also turning up. New candle opening above previous mentioned 61.8% at 1.3365 will be first signal of continuation in the pair.”

U.S. markets open on strong note after ADP report; Dollar and Yen slightly down

Dow Jones Industrials Index goes through gains by 0.71& while the Nasdaq Index rises 0.45% and the S&P Index adds 0.94% in the first minutes of trading.

On the macroeconomic front, the ADP Employment Report has advanced a 491,000 job loss in April, somewhat below the 650,000 decline expected.

Euro and Pound, slightly higher

EUR/USD has jumped to intra-day high at 1.3375 after the ADP report although the pair has not been able to hold those levels and has dropped back to levels right above 1.3300.

GBP/USD has jumped from levels around to 1.5080, but has not been able to break above 1.5085 resistance and at the moment, the Pound remains around 1.5060.

USD/JPY has risen from 98.20 to levels right above 99.00 to pull back afterwards, at the moment the Dollar struggles with resistance level at 98.75/90.

Forex: EUR/USD: Euro pulls back from 1.3375 intra-day high

The nearest support level for the Euro lies at 1.3340, previous intra-day high, and below there, 1.3300; once below here, next support could come at 1.3375. On the upside resistance level lies tat the 1.3375/85 area, and above there, .3435 (May 5 high) and 1.3460/65.

On a longer term, Mohammed Isah, technical analyst at FXTechstrategy observes that the Euro remains trading above the broken declining channel; “Although weakness was seen on Tuesday with a follow through lower in early morning trading today, as long as the pair maintains above its broken falling channel, risk remains to the upside. In such a case, the 1.3434 level which is the location of its daily 200 emawill come in as the initial support ahead of its April 06’09 high at 1.3580 with a loss of there opening the door for more upside gains towards its Mar 23’09 high at 1.3738.”

Forex: USD/CHF falls 0.35% on the day to test 1.1300 level

Yesterday, the Greenback won 0.72% against the CHF, the pair opened at 1.1260, reached 1.1247 as minimum and 1.1362 as maximum, to close the day at 1.1341.

"The dollar is losing steam against the Swiss franc in early European trading, heading again towards the lows around 1.1250, and is currently trading at 1.1320. We expect these lows to be tested again in today’s hours, where we see very low volatility in the market, resulting in a sideways trend."

Forex: GBP/USD: The Pound climbs to 1.5090/15100 area after ADP report

In case of breaking above 1.5100, next resistance levels could be at 1.5160 (May 5 high), and 1.5190. On the downside, support levels lie at 1.5065 (Apr 16 high), and below there, probably on the 1.4990/1.5000 area.

GBP/JPY has rocketed more than 160 pips from levels around 147.55 to reach a fresh intra-day high at 149.35. Resistance levels lie at 149.70 and 151.50. On the downside, GBP/JPY could find support at 148.50 and 147.50.

Forex: USD/JPY: The Dollar reaches levels above 99.00 after ADP

In case of breaking above 99.00/10, the Dollar might find resistance at 99.65 (Mar 4 high) and than at 100.00. On the downside, support levels remain at 98.50/60 and below tthere, 98.25 and 98.00.

Forex: EUR/USD: Euro hits intra-day high at 1.3365 after ADP figures

On the upside, the Euro could find resistance around the , 1.3385 congestion area, and above there, 1.3435 (May 5 high) and then 1.3460/65. On the downside, support levels lie at 1.3300 and below there, 1.3275 if the Euro reaches below there, next support level comes at 1.3245.

EUR/JPY has boosted from 130.55 before the ADP report to levels around 132.35 resistance so far. Above here, next resistance levels lie at 132.85 and 134.35. On the downside, support levels lie at 131.05 and 130.30.

Euro and Pound rise on better than expected ADP Employment report

EUR/USD has been favoured by the ADP report and the pair has jumped from levels around 1.3280 to a new intra-day high at 1.3360 right after ADP data was released.

GBP/USD has jumped from levels right above 1.5000 to reach levels close to 1.5100 minutes after ADP data was released.

Forex: USD/CAD rises 0.40% to 1.1825, intra-day high

Yesterday, the pair rose 0.33% from 1.1727 opening price, reaching 1.1791 as maximum and 1.1680 as 2009 low, to close the day at 1.1768.

According to the Mataf.net analyst team, Loonie is in a downtrend: "1,1798. USD CAD is in an downtrend directed by 1H exponential moving averages. The volatility rises. Bollinger bands are deviated. ForexTrend 4H (Mataf Trend Indicator) is in a bearish configuration. The consolidation should continue. The price should continue to move in 1,1740 / 1,1850 range. Resistances: 1,1810 - 1,1850. Supports: 1,1740 - 1,1685."