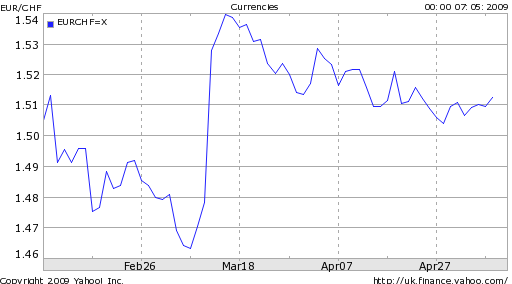

When the Swiss National Bank (SNB) announced oln March 12 that it would intervene in forex markets for the first time since 1994, the Franc immediately plummeted up to 5% against select currencies. Since then, the currency has largely clawed back some of its losses, prompting talk of round two: “Speculation about animminent intervention in the foreign-exchange markets was rife…after the euro fell to CHF1.5031, the lowest level seen since March 12 when the SNB began selling Swiss francs against euros.”

It was unclear whether the Central Bank had chosen a magic threshold, such that a rise by the Franc above which would trigger a sale of Francs in the open market. Earlier in the week, one analyst asserted, “With the euro/franc exchange rate almost at pre-intervention levels - the euro jumped to a level above CHF1.52 after the SNB intervention in March from CHF1.4843 before the announcement - the stage is set for the SNB to either put up or shut up.”

It was unclear whether the Central Bank had chosen a magic threshold, such that a rise by the Franc above which would trigger a sale of Francs in the open market. Earlier in the week, one analyst asserted, “With the euro/franc exchange rate almost at pre-intervention levels - the euro jumped to a level above CHF1.52 after the SNB intervention in March from CHF1.4843 before the announcement - the stage is set for the SNB to either put up or shut up.”

Sure enough, both the Chairman of the SNB as well as a board member both announced yesterday that the campaign to hold down the the Franc is still in effect, and will soon enter a new phase. Thus far, the Bank has relied on various forms of quantitative easing to deflate its currency, both through direct currency transactions and purchases of bonds. The goal of such quantitative easing is only proximately to deflate the Franc; the ultimate goal is to ward off deflation. Given that the Bank had already lowered its benchmark interest rate close to zero, manipulating its currency was/is one of its few remaining options. “As long as the environment does not improve and as long as deflation risks are visible in our monetary policy concept, we will stick to this insurance strategy resolutely,” said Chairman Jean-Pierre Roth.

As the economic recession takes hold, the Swiss economy is forecast to contract 3% in 2009, but to grow in 2010. Consumer sentiment has fallen to the lowest level since 2003. Inflation, meanwhile is projected at -0.5%; deflation, in other words. Still, Switzerland maintains that its motivation is not to boost the economy, but only to increase monetary stability. National Bank governing board member Thomas Jordan “reiterated the interventions have nothing to do with a beggar-thy-neighbor policy, a strategy to weaken a country’s currency to improve the situation for domestic exporters.”

Given that forex intervention is usually doomed to failure, the SNB must rely on a combination of luck and improved fundamentals to keep the Franc down. Thus, when the next round of intervention was announced yesterday, the Franc fell by a modest .75% against the Euro, as investors largely shrugged of the news. Fortunately, the initial pledge to intervene coincided with a pickup in investor sentiment, and decline in risk aversion. This has reduced demand for the Swiss Franc, which had previously been bid up as a so-called “safe haven” currency. As long as the stock market rally continues, investors will stick to higher-yielding currencies and the Franc should be “safe.”

0 comments:

Post a Comment