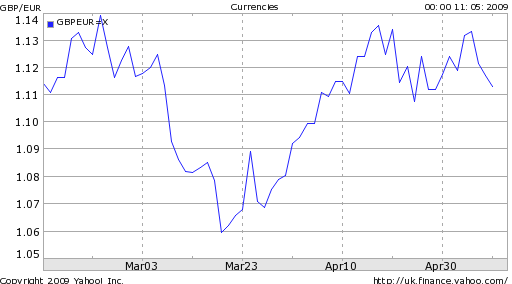

The Pound is holding its own against the USD, even touching a four-month high last week. But against other major currencies, the story is just the opposite. While managing to avoid parity against the Euro, for example, the Pound has nonetheless remained range-bound against the common currency. The Australian Dollar, meanwhile, has risen to $2 against the Pound for the first time in 13 years.

How to explain the stagnation of the Pound? It depends on which currency pair you look at. Against the Dollar, the narrative remains one of risk aversion; when stocks rise, so usually does the Pound. “The U.K. pound is joining other currencies in beating up on the dollar,” announced one analyst on a day that stocks and commodities rallied broadly. The Pound has also been able to hold its own against the Dollar because both currencies’ Central banks have embarked on similar quantitative easing plans, which could prove equally inflationary in the long run. [Chart courtesy of Economist].

In fact, the Bank of England just announced a huge expansion in its program, increasing total debt buying (i.e. money printing) by $50 Billion. One analyst summarized the impact of this announcement on forex markets as follows: “The Bank of England’s aggressive stance with regard to quantitative easing is adding to concern about the economy and that is negative for sterling.” Not much nuance there….

In fact, the Bank of England just announced a huge expansion in its program, increasing total debt buying (i.e. money printing) by $50 Billion. One analyst summarized the impact of this announcement on forex markets as follows: “The Bank of England’s aggressive stance with regard to quantitative easing is adding to concern about the economy and that is negative for sterling.” Not much nuance there….

In fact, this is especially bad for the Pound against the Euro, where a juxtaposition of the Central Banks’ respective approaches to the credit crisis reveals stark differences: “The weakness in the pound suggests the market is drawing a contrast between the ECB, which seems to be dragging its legs on quantitative easing, and the BOE, which is still ‘full-steam ahead.’ ” Where the ECB is providing liquidity indirectly in the form of swaps and guarantees, the BOE is printing money and injecting it right into capital markets.

“Mervyn King, governor of the Bank of England, has said the exit strategy will be dictated by the outlook for inflation and that central banks should not support markets that cannot survive on their own,” but investors remain skeptical and for good reason. “Britain will sell a record 220 billion pounds of gilts this fiscal year, 50 percent more than last year.” Based on the fact that yields have risen for four straight weeks (against the backdrop of the first “failed” auction ever for UK government bonds), there is doubt that the government can finance its deficits.

The BOE continues to be roundly smacked with criticism, for its role in fomenting the credit crisis and in not adequately responding to it: “It happens that in the early years of inflation targeting, it did produce a stable economy. But I think it’s now clear that it can’t, by itself, produce a stable economy,” argued one commentator. Unemployment rates in the UK remain at frighteningly high levels. The government’s own economists (which aremore optimistic than third-party forecasts) forecast GDP at -3.5% for 2009, with a modest recovery in 2010. Of course, these forecasts should be taken with a grain of salt, as they hinge on the crucial assumption that the BOE’s interest rate cuts and quantitative easing plan will soon trickle down through the economy, proof of which has still not been observed.

As a result, I’m personally between neutral and bearish for the UK Pound. For as long as stocks continue to rally, investors will remain Adistracted. If and when the rally loses steam (I am skeptical that the rally is sustainable), they will quickly turn their attention to comparative economic and monetary conditions; suffice it to say that Pound won’t stack up well.

0 comments:

Post a Comment