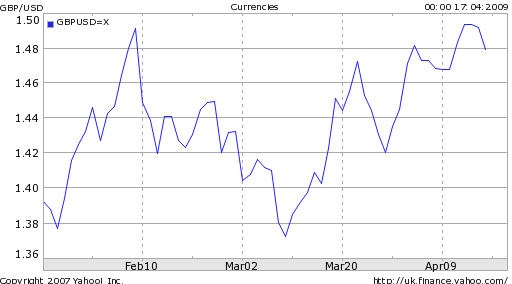

The British Pound recently touched a 3-month high against the US Dollar, and market players are betting the currency’s run will continue: “Traders are paying a 0.25 percentage-point premium for one- week call options on the pound relative to puts, according to data compiled by Bloomberg.” In other words, more investors believe the Pound will rise than believe it will fall.

The Pound is faring especially well against the Euro, and the possibility of parity is becoming increasingly remote. “ ‘There are more and more people thinking there will be prolonged declines in the euro, especially against the pound,’ ” summarized one analyst.

Bulls attribute the sudden strength to an improvement in the real estate market. “A survey from the Royal Institution of Chartered Surveyors (Rics) found that new inquiries in the housing market had increased for the fifth consecutive month in March, ” en route to breaching a six-year high. Mortgage lending, which would necessarily be required to support this increased demand, are also rising, albeit from an “abysmal low.” Meanwhile, prices are still falling in the majority of markets, and real estate agents remain pessimistic.

The economic picture is still grim. A review of the UK economic timeline reveals that while the financial sector seems to have (been) stabilized, most economic indicators continue to trend downwards. “Economists predict the Treasury will anticipate a 3-3.5 percent slowdown in the economy this year, much more than a forecast in November for a 0.75-1.25 percent slowdown.” The budget is scheduled to be released later this week, and analysts expect a wide budget deficit that will need to be fueled by an increase in borrowing and/or the printing of new money. Speaking of which, the Bank of England is in the same position as its counterparts in the EU and US, which implies that the Pound should be trading at a consistent level with the Dollar and Euro.

In short, it’s difficult to ascertain whether the Pound’s recent upside is a product of technical factors or a genuine improvement in the fundamental situation. On the technical side, the currency had probably become oversold from irrational risk aversion, and the current rally could represent a pullback. Until there is definitive evidence that the British economy has turned the corner and/or that the BOE plan shows signs of success, I would advise skepticism.

0 comments:

Post a Comment